WEEKLY MARKET SUMMARY

Global Equities: Markets were slightly lower on a holiday-shortened week as investors turned the calendar to 2025. A Friday bounce mitigated early-week selling, with the S&P 500 and Nasdaq Composite both falling -0.5% while the Dow Jones Industrial Average slipped -1.1%. Small caps outperformed with a weekly gain of 0.9%. Developed International stocks fell -0.6% and Emerging markets closed the weekly session down -0.4%.

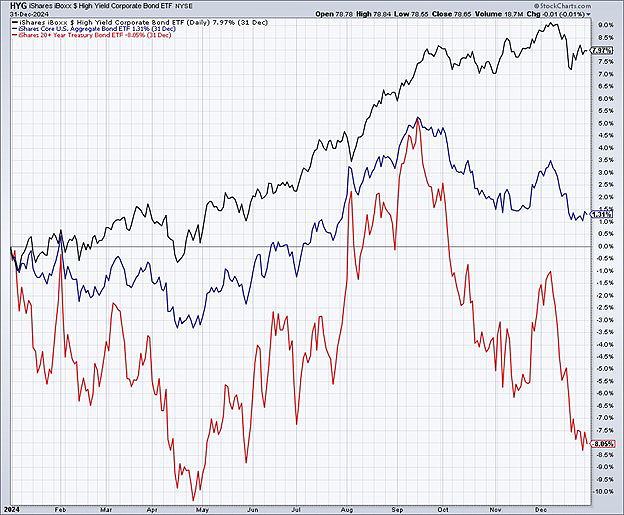

Fixed Income: The 10-year Treasury yield eased to 4.6% after ending 2024 around the highs of the year. Overseas, Chinese yields plummeted to a multi-decade low of 1.9% on deteriorating growth expectations and a growing deflationary spiral. High yield bonds rallied during the week to gain 0.5%, continuing the momentum of a stellar year that saw the asset class gain more than 8%.

Commodities: US West Texas Intermediate Crude prices rose above $74 as an Arctic cold snap hit the US. European natural gas prices surged as the flow of Russian gas through Ukraine was halted.

WEEKLY ECONOMIC SUMMARY

ISM Manufacturing: The Institute for Supply Management Manufacturing gauge improved from 48.5 to 49.3 in December, still contracting albeit at a slower pace. The reading was better than expected, highlighted by an increase in new orders. A separate report on the Purchasing Managers’ Index Manufacturing component rose to 49.4, also better than expected. Weakness in the manufacturing sector has been more than made up for by strength in the services sector.

Rates Weigh on Mortgage Demand: The average 30-year fixed rate mortgage rose above 7% during the week, worsening affordability for potential homebuyers who were anticipating cheaper mortgages after the Fed cut rates twice. Applications for purchases fell -6.8% during the week and refinancing applications cratered -23.4%. Home prices aren’t getting any cheaper, either. The Case-Shiller Home Price Index rose 0.3% during October and is up 4.2% year-over-year.

Chinese Economic Woes: Chinese President Xi Jinping issued a New Year’s address that included comments on the economic challenges facing the nation, uncommon in the annual speech. Chinese leaders have been trying to spur public borrowing and increase consumer spending amidst a weak economy that is struggling with deflation and a property sector collapse. With potential US tariffs looming over China, Xi desperately needs to inspire confidence in his leadership as economic growth is poised to fall below 5% in 2025.

CHART OF THE WEEK

The Chart of the Week shows the performance of the iShares iBox US High Yield ETF (black line, ticker HYG), the iShares Core US Aggregate Bond ETF (blue line, ticker AGG), and the iShares 20+ Year Treasury Bond ETF (red line, ticker TLT). Despite spreads over Treasuries that are near historic lows, high yield bonds delivered solid returns in 2024 amidst a benign default environment. Longer-duration bonds, on the other hand, gave up all their 2024 gains after the Fed signaled fewer 2025 rate cuts. Could there be a bottom forming for longer-duration bonds? Possibly, but with uncertainty over tariffs, tax cuts, and other inflationary proposals, yields could be in store for one more upward move in early 2025.