WEEKLY MARKET SUMMARY

Global Equities: Equity markets remained uneasy as corporate earnings season got underway, with no clarity and no deals on tariffs continuing to weigh on investors’ confidence. The S&P 500 slipped -1.5% despite stellar earnings from major banks, while the Dow Jones Industrial Average dropped -2.7% after its largest component stock, United Healthcare (UNH), plunged over -22% on Friday. The Nasdaq Composite was also down during the week, slipping -2.6% after Nvidia (NVDA) was banned from selling its chips to China. Small Cap stocks enjoyed a rare week of relative strength, gaining 1.1%. Developed International stocks posted significant outperformance over their US peers, gaining 2.7% during the weekly session as the European Central Bank issued further rate cuts. Emerging Markets ended the week slightly higher, gaining 0.4%.

Fixed Income: Bond market volatility subsided during the week, but the US 10-Year Treasury yield remained elevated at 4.33%. By comparison, the yield on Greek 10-Year bonds is nearly 1% lower despite Greece possessing a credit rating barely above junk status. The European Central Bank cut rates for the seventh time since June 2024 to bring its lending rate to just 2.25% while the US Fed has only cut rates three times and has signaled no intention of cutting when it meets in May. Despite the uncertainty over the path of the US economy, high yield bonds performed well during the week, gaining 1.3%.

Commodities: US West Texas Intermediate (WTI) Crude prices rose during the week to end at $64.29. Gold continued to be the safe-haven play of choice for investors seeking refuge from the trade war drama, rising to $3,334.70/oz.

WEEKLY ECONOMIC SUMMARY

Semiconductor Tariffs: At the start of the week, it seemed like good news for shares of semiconductor stocks, as news surfaced that semiconductors and phones would be exempt from the tariffs. Later, it was clarified that these products would simply be subject to their own specific tariffs to be announced later. Then, on Tuesday, Nvidia (NVDA) announced that the US government had banned it from exporting its H20 chips to China, resulting in $5.5 billion charge for the first quarter and likely much more lost revenue in the following quarters. The H20 chips were specifically designed to comply with US export regulations, so the reversal was a surprise and caused a major selloff in NVDA shares and in semiconductor stocks across the board.

Trump Targets Powell: Fed Chair Jerome Powell spoke during the week and did not hold back his opinion of the tariffs, noting that the inflationary effects of higher prices while simultaneously slowing domestic growth would limit the ability of the Fed to control both sides of its dual mandate (price stability and full employment). Effectively, Powell was referring to stagflation, a condition of slowing growth and rising prices. Powell rattled markets by saying there was no “Fed put” to the market turmoil, meaning the Fed is not getting ready to step in and cut rates in response to the market selloff. The comments drew the ire of President Trump, who took to social media to say, “his termination can’t come fast enough”, among other critiques. Powell is set to serve out the remainder of his term through May 2026.

Earnings Update: Big banks kept the good earnings going with beats from Goldman Sachs (GS), Bank of America (BAC), and Citi (C). United Airlines (UAL) also posted strong earnings, sending its shares 6% higher. United Healthcare (UNH) posted disastrous results, and a guidance cut that saw shares crater -22%. Netflix (NFLX) reported after the bell to end the holiday-shortened week, with another strong quarter and a 4.4% post-market bump.

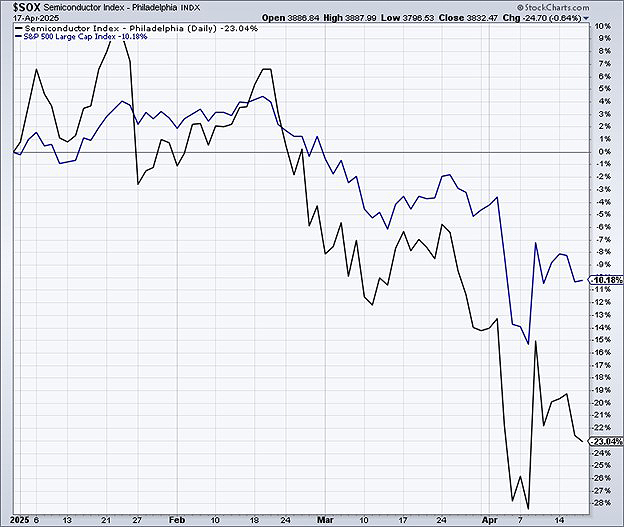

CHART OF THE WEEK

The Chart of the Week shows the year-to-date performance of the PHLX Semiconductor index (black line), a market-cap-weighted index of the 30 largest US-traded companies in the semiconductor industry, along with the S&P 500 (blue line). Tariffs have been bad news for all stocks, but semiconductors have been hit especially hard due to national security concerns related to artificial intelligence. With US-China trade effectively halted for the time being, foreign companies such as China’s Huawei will be the main beneficiaries and step in to fill the demand. Ultimately, if left in place for a prolonged period, the semiconductor tariffs are likely to accelerate the rise of the Chinese artificial intelligence industry.