WEEKLY MARKET SUMMARY

Global Equities: US stocks got a Friday bump from stronger-than-expected jobs data to cap off a solid week of gains, shrugging off a tense debate over the Republican budget bill that included a social media feud between President Trump and Elon Musk. The S&P 500 closed out the week back above the 6,000 level on the back of a 1.5% gain. Big tech companies returned to the forefront of market leadership, propelling the Nasdaq Composite to a 2.2% weekly advance, while the Dow Jones Industrial Average returned 1.2%. US Small Cap stocks picked up momentum with a 3.3% gain. Developed Market international stocks gained 1.1%, while Emerging Markets rose 3.1% as US-China trade tensions eased.

Fixed Income: A solid May jobs report put a final nail in any hopes for a June rate cut, and July has become highly unlikely as well. With no August Fed meeting, the earliest expected rate cut is now September, at just a 60% probability according to Fed Funds Futures data from CME Group’s FedTracker. 10-Year Treasury yields were relatively unchanged during the week, rising slightly at week’s end to above 4.5%. High yield bonds were up slightly during the week, rising 0.1%.

Commodities: US West Texas Intermediate (WTI) Crude prices rose to $64.73 on renewed optimism on US-China trade talks. US drillers continue to idle rigs, dragging the US active rig count lower for a sixth consecutive week to levels not seen since the 2021 lows. Gold has been the safe-haven metal of choice this year, but this week was all about silver, which surged over 9% during the week to a 13-year high.

WEEKLY ECONOMIC SUMMARY

Jobs Market Proves Resilient: Investors were nervous headed into Friday’s jobs report after data from ADP showed the lowest private sector hiring in more than two years. Thus, the better-than-anticipated non-farm payroll gain of 139,000 in May brought relief; although for those hoping for Fed rate cuts, the strong jobs market gives the central bank more wiggle room to wait. The unemployment rate was steady at 4.2%

Services Data Contracts: The Institute for Supply Management’s (ISM) Services Purchasing Managers’ Index (PMI) unexpectedly contracted in May, just barely, at 49.9. Any reading below 50 indicates contracting activity. This marked the first contraction for the index since June of 2024. Survey data showed participants cited difficulties in making forecasting and planning decisions due to tariff uncertainty. A separate survey from ISM on Manufacturing also showed contracting activity, with tariff uncertainty also the driving factor.

Budget Bill Turmoil: The so-called “Big, Beautiful Bill” was the focal point of a public spat between one-time allies President Trump and Elon Musk, just days after Trump thanked Musk for his DOGE work in an Oval Office press event. Musk called the budget bill a “disgusting abomination” due to its projected $2.5 trillion increase to the Federal debt. The bill passed the House easily but has faced stiffer resistance in the Senate as several GOP lawmakers have voiced their concerns over the growing debt burden after the party took power on the promise to shrink government spending. The bill is currently moving through the budget reconciliation process, which allows for passage by simple majority (51 votes) rather than the typical 60-vote threshold.

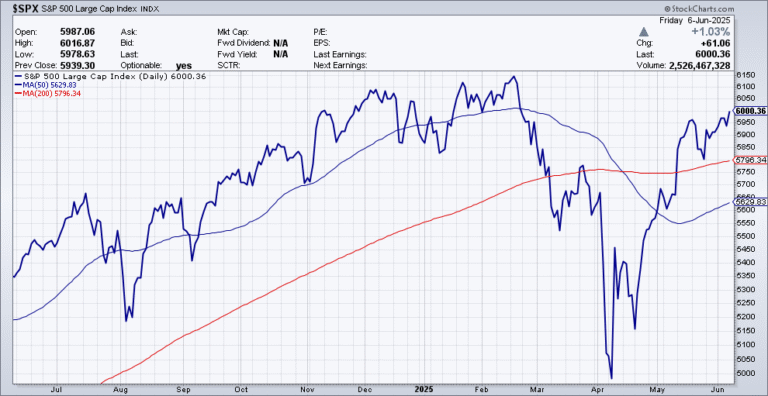

CHART OF THE WEEK

The Chart of the Week shows the S&P 500 index, which this week surpassed the 6,000 level for the first time since February. The tariff selloff in the markets occurred in two phases, first when President Trump imposed tariffs on Mexico, Canada, and China in February, and then the dramatic plunge on the April 2nd “Liberation Day” press conference that extended tariffs to essentially the entire global marketplace. However, the strength of the US economy and jobs market, along with relatively benign inflation, has given investors confidence to re-invest in stocks. President Trump’s abrupt reversals of some tariffs have also played a role, as investors quickly realized that markets can turn on a dime in the current environment.