WEEKLY MARKET SUMMARY

Global Equities: Stocks pulled off a 5-day winning streak on continued momentum from de-escalation of the trade war and soft inflation data that eased recession worries. Technology stocks were best performing sector during the week, thanks in part to talk of relaxed trade restrictions for semiconductors and news of a massive Saudi Arabian data center. For the weekly session, the Nasdaq Composite led the way with a 7.2% jump, the S&P 500 ended 5.3% higher, and the Dow Jones Industrial Average gained 3.5%. US small cap stocks were 4.5% higher during the week. US stocks outperformed their foreign developed-market peers, which gained 1.5%, while Emerging markets were up 3.0% during the week.

Fixed Income: The 10-Year US Treasury yield looked poised to close out the week relatively unchanged at 4.4% but shot up to 4.5% right after the Friday market session closed after Moody’s announced a downgrade of the US debt rating. Moody’s cited the increasing burden of servicing the nation’s debt, which could grow by more than $2.5 trillion over the next decade under the proposed tax bill working its way through congress. Corporate bonds turned in another strong weekly performance, with investment grade bonds gaining 0.5% and high yield bonds up 1.1%, thanks to lowered recession expectations.

Commodities: US West Texas Intermediate (WTI) Crude prices were relatively stable around $61.75. US shale production has been slowed down as lower prices limit profitability, with Diamondback Energy (FANG) noting, “We currently estimate that the U.S. frack crew count is already down ~15% this year, with the Permian Basin crew count down ~20% from its January peak, and both are expected to decline further,” in a letter to shareholders. Gold prices rose during the week despite soft inflation data, ending at $3,245/oz.

WEEKLY ECONOMIC SUMMARY

Soft Inflation: April data on Consumer (CPI) and Producer (PPI) price indices came in softer than anticipated, which eased fears of a recession but also pushed back expectations for a Fed rate cut. CPI data for both the headline and Core (ex-food and energy) showed a 0.2% monthly increase. Falling energy costs were a contributor to the overall decline, while shelter and medical care costs continue to run hot. PPI data revealed declining profit margins, suggesting that some firms are attempting to absorb tariff expenses without passing along those costs to customers, for the time being.

US Retail Sales: Pessimism over high tariffs did not deter US consumers from spending in April, bolstering confidence that the US economy can weather the trade war for the time being. Retail sales were up 0.1% for the month and 5.2% year-over-year. Core retail sales, which exclude car dealerships, gas stations, and restaurants, declined by 0.1% but were still up 5.1% annually.

Earnings Update: The impact of tariffs was a major topic in the earnings call of America’s largest retailer, Walmart (WMT). Walmart beat earnings forecasts but missed on revenue, and warned that price increases would likely start later this month, impacting groceries and consumer goods across most categories. Walmart’s CFO noted, as an example, a potential $100 price increase on $350 car seats imported from China. President Trump immediately took to social media in response, stating, “Walmart made BILLIONS OF DOLLARS last year, far more than expected. Between Walmart and China they should, as is said, “EAT THE TARIFFS,” and not charge valued customers ANYTHING. I’ll be watching, and so will your customers!!!”

CHART OF THE WEEK

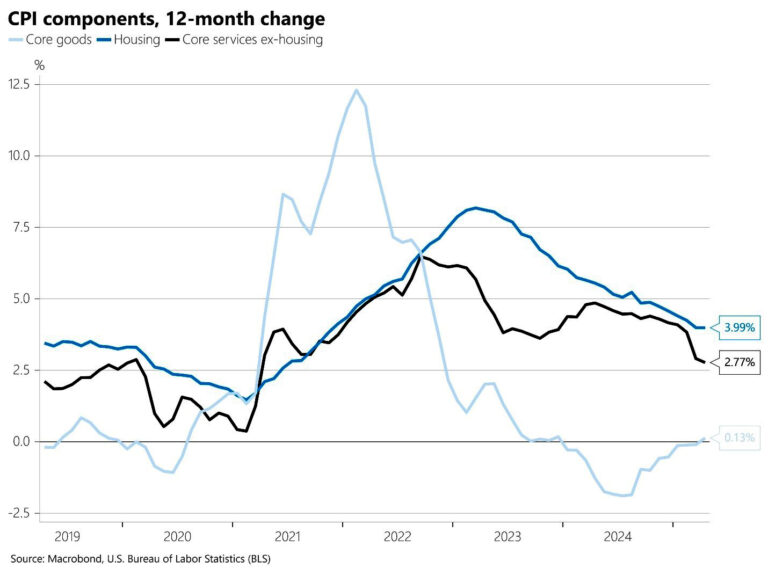

The Chart of the Week shows the annual change in the three major components of the Core Consumer Price Index. Core goods inflation has been flat-to-negative for over a year, but price pressure from services and housing has kept the overall reading above the Fed’s 2% target. Both services and housing are trending in the right direction, but housing remains the biggest challenge for the Fed to resolve. High interest rates are preventing “locked-in” homeowners with low mortgage rates from listing their homes, limiting the supply of available housing. Yet, if the Fed quickly lowers rates, there could be a demand surge as buyers rush in, which would put additional upward pressure on home prices, further increasing housing inflation. With housing inflation stuck, the Fed’s solution remains “wait and see” and rate cut expectations have been pushed back to later in the year.