WEEKLY MARKET SUMMARY

Global Equities: US stocks moved lower in weekly trading as the Senate advanced the Republican “Big, Beautiful Bill”, which the Congressional Budget Office warned will add $3.1 trillion to the national debt over the next decade. Concerns over the unsustainable government spending caused Treasury bond yields to spike higher, increasing the risk premium, or additional return, investors expect to earn on risky stocks. The S&P 500 ended the weekly session down -2.6%, the Nasdaq slipped -2.5%, and the Dow Jones Industrial Average fell -2.4%. US small-cap stocks, which are generally more interest-rate sensitive, underperformed with a -3.5% weekly pullback. Developed International stocks brushed off President Trump’s threat of 50% tariffs on the European Union and ended the week 0.9% higher. Emerging Market stocks also outperformed their US counterparts with a very slight -0.1% decline.

Fixed Income: The 10-Year US Treasury yield was only up slightly following a downgrade of the US debt by Moody’s but slid further as the budget bill worked its way through Congress, clearing the House and making its way to the Senate for debate. A weak 20-Year auction on Wednesday triggered a selloff in government bonds and 10-Year Treasury yields hit 4.62% before easing to 4.5%, while the 30-Year yield reached 5.15% before pulling back to end the week just above 5%. High yield bonds slipped -0.6% during weekly trading in response to the increase in rates.

Commodities: US West Texas Intermediate (WTI) Crude prices bounced around during the week but ended relatively unchanged at $61.62 as of Friday afternoon. OPEC+ may be poised to flood the market with crude this summer, with a 411,000 barrel-per-day hike on the table for July, which would be triple the original planned amount from the cartel. OPEC+ will meet June 1st to set their output targets.

WEEKLY ECONOMIC SUMMARY

Mortgage Rates Surge: The cost of the average 30-year fixed rate mortgage rose to the highest level since February, at 6.96% according to Bankrate. The high borrowing costs, combined with elevated home prices that have not fallen as quickly as other inflation categories, are pricing buyers out of the market. April existing home sales were the worst for the month since 2009 and with the Fed not budging on interest rates, could continue to fall through the normally strong spring season.

Tariff Talk Returns: Markets had rallied in the absence of tariff rhetoric, but President Trump took to social media on Friday to lash out against the European Union for being “very difficult to deal with” and recommended a “straight 50% tariff on the European Union, starting June 1, 2025.” President Trump also reprimanded Apple (AAPL) and demanded they build their iPhones in the US or face a 25% tariff. The EU is the second largest purchaser of US exports, taking in nearly $351 billion in goods in 2022. The threat was short-lived, however, as Trump backed off over the weekend and stated he would pause the tariffs until July.

Earnings Update: Retailers are beginning to feel the strain of tariffs, as they attempt to absorb the impact but are now warning that those costs will soon be passed along to customers, if they haven’t already. Home Depot (HD) posted a rare miss on earnings, breaking a nineteen-quarter streak of beats as the company stated it was eating the cost of tariffs. Target (TGT) also missed as spending declined, and the retailer said it would be increasing some prices to offset the tariff impact. Aside from retail, earnings were better, with Snowflake (SNOW) reporting a big earnings beat, which sent shares 10% higher. Next up is arguably the most important earnings release with Nvidia (NVDA) posting results on May 28th.

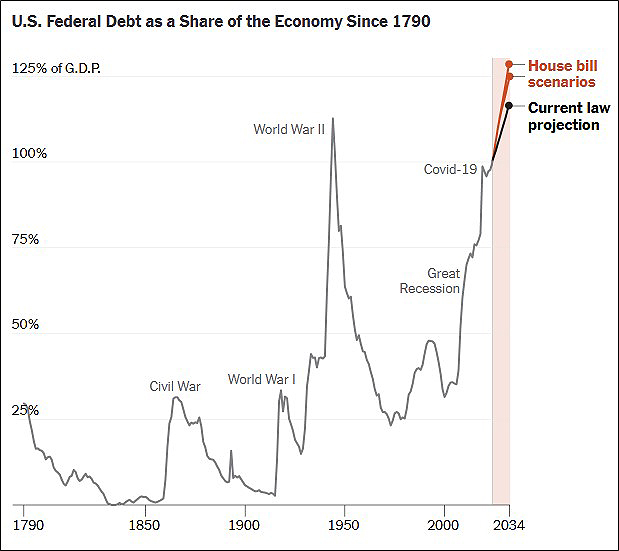

CHART OF THE WEEK

The chart of the week shows the projected growth of the US Federal Debt as a percentage of Gross Domestic Product. The nonpartisan, non-profit Committee for a Responsible Budget examined the growth of the Federal debt burden in three scenarios; under current law, as proposed in the “Big, Beautiful, Bill”, and lastly, if the proposed tax cuts were made permanent. In all cases, the debt burden is outpacing economic production at an unsustainable rate, which has prompted a rebellion in the bond market. Bond investors are trying to send a message to Congress that the US will have to pay up in the form of higher rates to fund the proposed spending. Unfortunately, this creates a vicious cycle of higher interest payments on the debt, and therefore an ever-increasing debt burden. In past bond market tantrums, the Fed has stepped in to provide liquidity, which may happen again, but likely not until there is a panic event in the markets. Until then, Congress will continue to spend and try to kick the can down the road once again.