WEEKLY MARKET SUMMARY

Global Equities: US stocks slipped late in the holiday-shortened week but still managed to end with gains thanks to strong earnings and hopes that US judges may be able to halt President Trump’s tariffs. For the week, the S&P 500 ended up 1.9%, the Nasdaq Composite advanced 2.0%, and the Dow Jones Industrial Average gained 1.7%. US Small Caps were up 1.2% while Developed International stocks gained 0.9%. Emerging markets lagged, ending the week down -1.5%.

Fixed Income: The 10-Year US Treasury yield eased to 4.42% as bond market volatility subsided a bit. Minutes from the May Federal Reserve policy meeting showed the Fed is concerned about “difficult tradeoffs” that could arise from a stagflationary environment of slowing growth and rising prices. The Fed remains unlikely to lower rates at its June meeting. High yield bonds had another strong weekly performance, gaining 0.8%.

Commodities: US West Texas Intermediate (WTI) Crude prices fell on Friday to $60.71 on news that OPEC+ may hike oil production by more than the proposed 411,000 barrel per day increase beginning in July. Domestic oil production fell for the fifth consecutive week, to its lowest level since November 2021 as US drillers continued to idle their rigs amidst concerns over global demand.

WEEKLY ECONOMIC SUMMARY

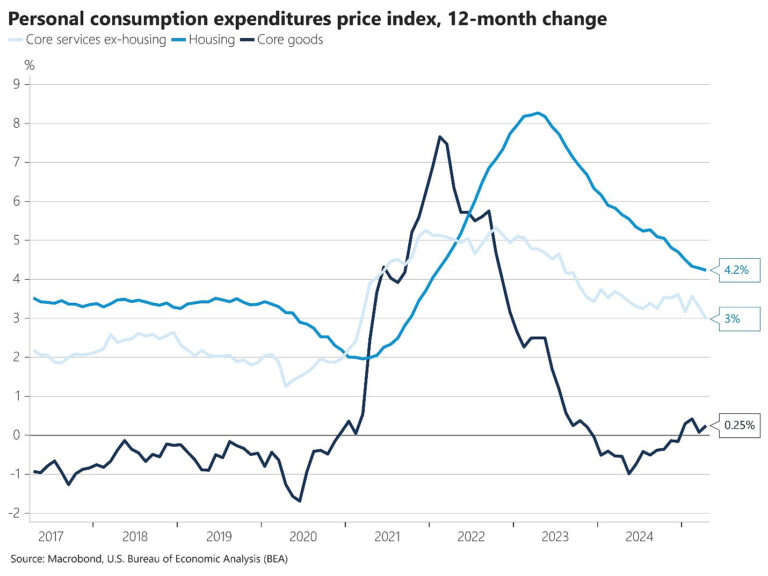

PCE Inflation Eases: The Fed’s preferred inflation measure, the Core Personal Consumption Expenditures (PCE) Index, came in as expected in April at +0.1%. Year-over-year, Core PCE is at 2.5%. Shelter accounts for the bulk of inflation and declined slightly from 4.3% to 4.2% annually. The Fed is unlikely to budge on rates at the June policy meeting due to the substantial uncertainty surrounding tariffs and trade.

“TACO” Trade? Nearly two months after “Liberation Day”, traders have keyed in on the pattern of aggressive tariff announcements followed by a quick reversal. President Trump’s chaotic trade negotiations have been dubbed the “TACO” trade, short for Trump Always Chickens Out. When informed of the acronym, President Trump was not amused, and there could be another escalation looming after he took to social media on Friday accusing China of violating the 90-day tariff truce, stating China “totally violated its agreement with us. So much for being Mr. Nice Guy!” Markets pulled back in response to the post, although Trump stated he would be speaking with President Xi at some point and hasn’t announced retaliation, yet.

Earnings Update: The engine that powers the artificial intelligence boom, Nvidia (NVDA), reported earnings and once again delivered staggering results. Nvidia reported revenue of $44.1 billion for the quarter, up 69% year-over-year, and delivered EPS growth of 33%. The company was able to beat expectations despite a $4.5 billion write down of chips that were produced for the Chinese market but then banned by export restrictions. Data center revenue grew at 73% annually, signaling strong demand for Nvidia’s industry-leading AI chips.

CHART OF THE WEEK

The Chart of the Week shows the components of the Core PCE index, the yardstick by which the Federal Reserve measures inflation. Core goods prices ticked higher but thus far are not causing significant inflation despite tariffs. Services and Housing are the bigger challenges for the Fed, but both are trending in the right direction. High housing prices and the potential for tariffs to reignite inflation are the reason the Fed has refused to cut rates. The odds of a June cut are less than 5%, with market futures suggesting no rate cuts until September.