WEEKLY MARKET SUMMARY

Global Equities: Markets finally got a breakthrough in trade talks, yet it wasn’t enough to spur stocks to a weekly gain as the S&P 500 ended the week down slightly at -0.5%. The Nasdaq Composite closed the weekly session with a -0.3% dip and the Dow Jones Industrial Average ended down -0.1%. Small cap stocks slightly outperformed with a 0.2% gain, while Foreign Developed and Emerging Market stocks both declined -0.2% during the week.

Fixed Income: The 10-Year US Treasury yield moved higher following an expectedly uneventful Federal Reserve announcement, touching 4.4% on Friday and ending at 4.39%. Apple (AAPL) issued $4.5 billion in corporate bonds, with the 10-year offering selling at a spread of 50 basis points above Treasuries. High yield bonds were flat during the week, and April’s issuance of new high-yield bonds was reported at a seventeen-year low for the month as tariffs concerns caused borrowers to pause.

Commodities: US West Texas Intermediate (WTI) Crude prices clawed back above $60 a barrel, trading at just under $61 as of Friday afternoon. Gold prices surged early in the week back towards all-time highs around $3,400/oz before cooling off and ending the week at $3,334 to snap a two-week losing streak.

WEEKLY ECONOMIC SUMMARY

FOMC Remains Paused: As expected, the Federal Open Market Committee held rates unchanged this week, with Chair Jerome Powell pointing to continued uncertainty due to tariffs. In his remarks, Powell noted that risks are present to both sides of the Fed’s dual mandate of full employment and low prices. While inflation has moderated and is closer to the Fed’s 2% target, the potential inflationary effects of tariffs could quickly reverse that progress. On the jobs front, the Fed doesn’t see any major damage within the data, which gives them flexibility to wait and see. President Trump was predictably angered by the decision, calling “Too Late” Powell a “fool” who “doesn’t have a clue.”

Deal, or No Deal? President Trump secured his first “win” of the trade war this week in the form of a preliminary agreement with the UK. The terms of the deal dictate the US removal of 25% tariffs on UK steel and aluminum and dropping tariffs on UK automobiles to 10% for the first 100,000 units exported annually. The UK will, in turn, remove tariffs on US ethanol and purchase US beef and other agricultural products. Both countries said negotiations will continue with other products and industries potentially added. The Trump administration also announced a weekend meeting between Treasury Secretary Scott Bessent and Chinese trade officials in Switzerland. While there are no expectations that a deal will be hashed out, the meeting marks the first formal trade talks between the nations.

Earnings Update: Disney (DIS) was the big winner this week, with surprisingly strong streaming subscriber growth that propelled shares 10% higher. Super Micro Computer (SMCI) stock slipped over 6% on an earnings miss and weak guidance due to tariffs. Advanced Micro Devices (AMD) posted strong results but was also hampered by export controls that restricted sales of GPUs to China. Palantir (PLTR) slipped -8% despite beating estimates as some investors are having a hard time justifying the stock’s lofty valuation at 520x trailing earnings.

CHART OF THE WEEK

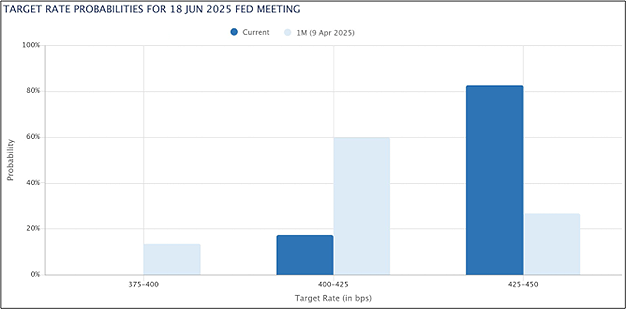

The Chart of the Week shows the market expectations for interest rates following the June 18th Fed meeting, per CME Group’s FedWatch tool. Prior to the May FOMC meeting, markets were pricing in a 60% likelihood of a 25 bps rate cut and a 14% chance of a 50 bps cut. Those expectations have fallen sharply after Powell’s comments, with just a 17% probability of a rate cut now. Powell made it clear that the Fed may not act even if unemployment spikes and GDP falls due to tariffs. This is because, as Powell has noted in the past, the Fed generally views inflation as the greater evil in a stagflationary economy (negative growth and rising prices). Corporate earnings have been good enough to buy President Trump some time to strike deals, but the clock is ticking and the Fed is telling markets they are not coming to the rescue this time.