WEEKLY MARKET SUMMARY

Global Equities: Volatility eased but investors remained anxious without clarity on the expected scope and duration of the fighting between Israel and Iran, prior to the weekend’s development of the US entering the conflict. The S&P 500 ended the week down -0.1%, while the Dow Jones Industrial Average gained 0.1% and the Nasdaq Composite also ended slightly higher, up 0.2%. US small caps also managed to close out the week positive, rising 0.4%. Developed International market stocks lagged with a -1.6% pullback after hitting overbought levels on technical strength indicators in the prior weeks. Emerging Markets were also lower, ending the week down -0.7%.

Fixed Income: As expected, fixed income investors got no help from the Fed as the central bank kept interest rates unchanged at the June policy meeting. The 10-Year Treasury yield eased slightly to 4.37% on rising risk-off sentiment due to rising geopolitical risks. High yield bonds were strong outperformers among fixed income asset classes, gaining 0.6% over the weekly session.

Commodities: US West Texas Intermediate (WTI) Crude prices inched up to $76 before easing on Friday to end the week at just under $75 a barrel. US drillers idled more active oil and gas rigs for an eighth week in a row, the longest consecutive streak of declines in the Baker Hughes rig count since September 2023. Despite heightened geopolitical turmoil, gold prices slipped to under $3400 an ounce.

WEEKLY ECONOMIC SUMMARY

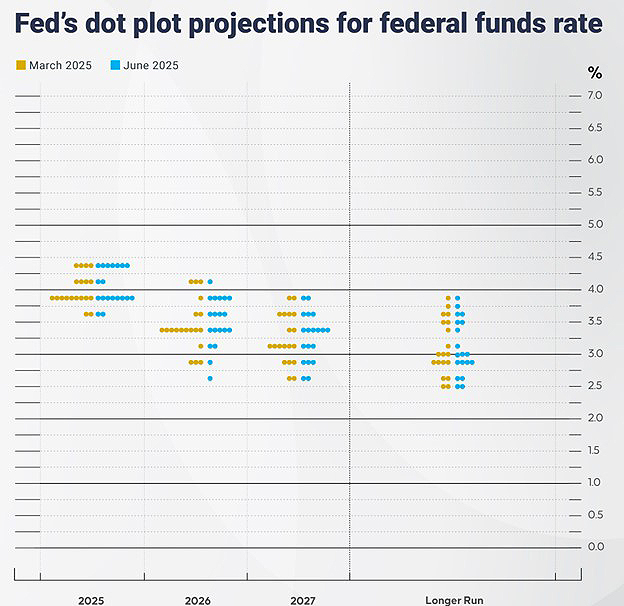

“Too Late” Powell? The Federal Reserve kept both interest rates and its consensus outlook for 2025 rate cuts unchanged at its June meeting, prompting a scathing response from President Trump who lobbed insults at Chairman Jerome Powell and accused other Fed members as being “complicit” in costing the US “hundreds of billions of dollars” by not cutting rates. The Fed cited elevated uncertainty due to the expected impact of tariffs, noting that while those effects have not yet materialized in the data, the central bank expects to see inflation rise to end the year 3% higher. While the consensus of the Fed is still for two 2025 cuts, there was a shift higher from some Fed members with seven now expecting zero cuts, compared to just four members in March.

Retail Sales Slip: US retail sales declined -0.9% in May, according to the US Census Bureau, the second consecutive monthly decline following a revised -0.1% dip in April. Notable decreases were seen in the Auto Sales and Building Materials & Garden categories. Economists attributed some of the decline to front running of tariffs in the preceding months, but there are signs that domestic demand is softening considering the data coincides with weaker manufacturing output.

Israel-Iran Conflict: Following Israel’s targeted strikes on key Iranian military personnel and nuclear scientists, the two nations continued to exchange rocket attacks while the international community sought a diplomatic solution. Over the weekend, the US joined the conflict, with the announcement that American bombers struck underground nuclear facilities in Iran. Defense Secretary Pete Hegseth stated that the bombing “was not and has not been about regime change”, but that sentiment was contradicted shortly thereafter in a social media post from President Trump stating, “It’s not politically correct to use the term, ‘Regime Change,’ but if the current Iranian Regime is unable to MAKE IRAN GREAT AGAIN, why wouldn’t there be a Regime change???” MIGA!!!”

CHART OF THE WEEK

The Chart of the Week shows the March and June 2025 “Dot Plot” federal funds rate outlook from the Federal Reserve. While most Fed members still expect two cuts this year, there was a notable shift towards no cuts, with seven members now not expecting any changes. The Fed also cut its 2025 GDP growth projection from 1.7% to 1.4% and raised its inflation forecast from 2.7% to 3%. The slower growth, higher inflation outlook shows that stagflation is becoming a major concern for the Fed, as its policy tools are typically only able to address one side of the growth/price stability equation at a time.