WEEKLY MARKET SUMMARY

Global Equities: US equities reached new all-time highs but pulled back sharply on Friday on poor consumer sentiment and general uncertainty over government cost-cutting and the potential imposition of tariffs. The Dow Jones Industrial Average ended the week -0.4% lower, while the S&P 500 ended the weekly session with a -1.6% decline. The Nasdaq Composite underperformed as investors shifted to risk-off, closing -2.5% lower for the week. Small Caps were also sharply lower, ending with a -3.6% loss on the week. Developed International stocks have enjoyed a rare streak of outperformance over their US counterparts, and that run continued with a weekly loss of just -0.5%. Emerging markets were the winners for the week, however, ending with a positive weekly return of 1.1%.

Fixed Income: 10-Year Treasury yields fell during the week, ending at 4.44%. The move was attributed to a risk-off shift in sentiment Friday. Japanese bond yields have been rising steadily in recent weeks following the Bank of Japan’s newly implemented hands-off approach to fixed income markets. BOJ Governor Kazuo Ueda suggested the central bank could step in as a buyer in the event of any “abnormal” market activity and yield surge. US high yield bonds slipped on Friday along with stocks, ending the week with a slight loss of -0.1%.

Commodities: US West Texas Intermediate (WTI) Crude prices slipped below their 100-day moving average and ended the weekly session below $71 a barrel. The decline marked the fifth straight weekly loss. Gold prices once again flirted with the elusive $3,000/oz milestone, rising as high as $2,970 during the week. Gold has risen 10.5% year-to-date as investors have shown renewed interest in the precious metal amidst uncertainty over inflation and government debt.

WEEKLY ECONOMIC SUMMARY

Consumer Sentiment Slips: The February reading on US consumer sentiment fell to 64.7 from 71.7 in January, falling short of the median 67.8 estimate from economists surveyed by Bloomberg. Consumers struck a pessimistic tone on expectations for unemployment and inflation in the coming year. “If consumers continue to ramp up their spending to avoid large anticipated price increases, higher inflation expectations could become self-fulfilling,” according to Joanne Hsu, Director of Surveys at the University of Michigan.

FOMC Minutes: There were no surprises from the January Federal Open Market Committee Meeting minutes, with the central bank appearing unified in their view that hot inflation warrants caution and a pause in rate hikes. The FOMC also sounded alarms over the looming threat of tariffs and uncertainty surrounding immigration policies and their impact on the workforce and overall economy. The Fed has noted that low unemployment provides flexibility to remain on hold, although that could change as layoffs from the aggressive government cost-cutting measures of the DOGE commission have yet to appear in official jobs data.

Earnings Update: Walmart (WMT) was the most notable name reporting this week, and the mega-cap retailer’s shares went on sale to the tune of a -9% decline following a poor 2025 outlook. Despite the weak guidance, earnings were strong for the final quarter of 2024. Chinese e-commerce giant Alibaba (BABA) fared better, soaring 10% on an earnings beat that was powered by artificial intelligence and cloud storage business units.

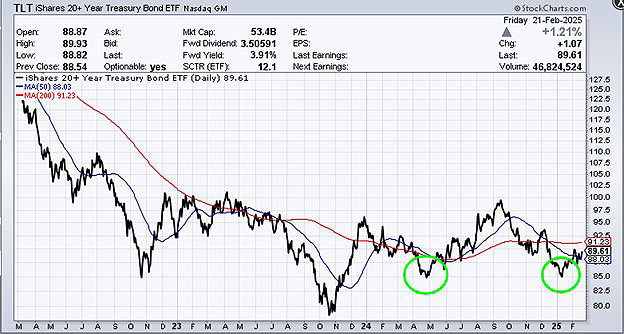

CHART OF THE WEEK

The Chart of the Week is a three-year look at the iShares 20+ Year Treasury Bond ETF, ticker TLT, representing long-term government debt. TLT has endured a brutal, prolonged downtrend that started with Fed rate hikes and continued as hot inflation cause the Fed to pare back its planned rate cuts. Repeated debt ceiling standoffs have caused many investors to shy away from long-term US debt, and the threat of further ratings downgrades remains a persistent threat. Yet, there is potential for a rapid rally in long bonds if inflation data rebounds in the coming months and January’s hot CPI turns out to be a seasonal anomaly. From a technical standpoint, it looks like there may be a double bottom as the $85 level on TLT was retested and held, for the time being.