WEEKLY MARKET SUMMARY

Global Equities: The shifting narrative around tariffs gave investors headaches and ultimately drove US stocks lower during weekly trading. The S&P 500 closed out the week with a -3.1% decline, the Nasdaq Composite shed -3.5% to fall into correction territory, and the Dow Jones Industrial Average dropped -1.5%. US Small Caps underperformed again with a -4.1% weekly loss. Developed International stocks outperformed as the European Central Bank cut rates and Germany announced increased defense spending measures, rising 3.5%, while Emerging Markets gained 2.8% on optimism over Chinese artificial intelligence stocks.

Fixed Income: 10-Year Treasury yields dipped as low as 4.11% during the week on tariff worries before bouncing back to 4.25% Friday to end the week relatively unchanged. Yield on German bunds registered their largest daily surge in 35 years, spiking 30 basis points in response to a coalition government plan to alter debt policy to fund additional defense spending. High yield bonds were modestly lower during weekly trading, dipping -0.4%.

Commodities: US West Texas Intermediate (WTI) Crude prices continued to decline, falling to $67 a barrel due to the potential impact of tariffs on inflation and global growth, along with an announcement from OPEC+ that the cartel would begin increasing production in April.

WEEKLY ECONOMIC SUMMARY

February Jobs Data: US nonfarm payrolls increased by 151,000 in February, an uptick from January’s revised 125,000 gains but slightly below expectations for a 160,000 increase. The unemployment rate was slightly hotter than expected at 4.1%. The report had little impact on markets, as investors are still waiting for the full impact of the looming tariffs and government job cuts to appear in the March data. According to data from Challenger, Gray & Christmas, which tracks job cuts, employers announced 172,000 layoffs in February, including 62,000 government cuts.

Fed Not Ready to Move: Fed Chair Jerome Powell participated in a policy forum at the University of Chicago’s Booth School along with other Fed officials on Friday, providing some additional insight into the Fed’s interest rate policy in advance of the March 19th Open Market Committee meeting. While Fed Fund futures markets have begun pricing in three 2025 rate cuts, Powell was predictably noncommittal and indicated that the Fed would be inclined to continue to wait and see before resuming cutting interest rates.

Tariff Turmoil: Markets were whipsawed by President Trump’s continuously evolving stance on tariffs, which were put in place on Canada and Mexico on Tuesday but then paused by Thursday. Chinese tariffs were increased further on Tuesday to roughly 30%, prompting a response from the Chinese embassy stating that “If war is what the US wants, be it a tariff war, a trade war or any other type of war, we’re ready to fight till the end”. Given the shifting and unpredictable nature of President Trump’s negotiation tactics, investors and economists have struggled to assess the potential impact of the cat-and-mouse game.

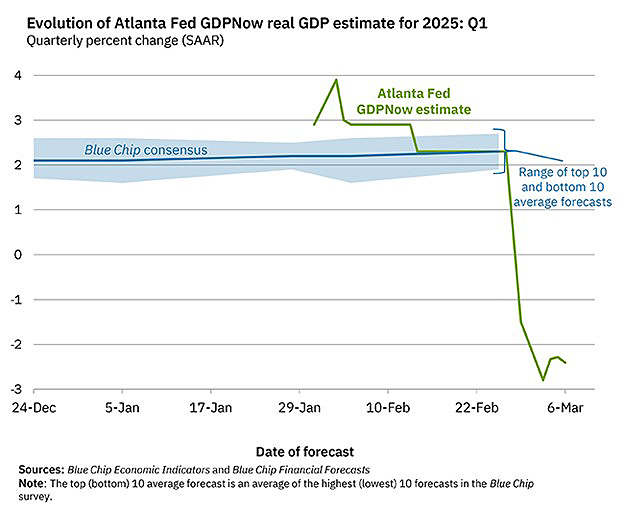

CHART OF THE WEEK

The Chart of the Week looks at the Federal Reserve Bank of Atlanta’s current first quarter Gross Domestic Product estimate, from its GDPNow model. The dramatic plunge in the estimated GDP from solid growth to contraction is largely attributable to a large decline in net exports as imports surged in anticipation of tariffs. It is important to keep in mind that GDPNow is a “nowcasting” model rather than a forecast, meaning it only factors in data that has come in thus far. So, while this could be a one-off event and the model may rebound as additional data comes in, investors must also consider the possibility that the US economy’s run of strong GDP growth could potentially come to an end in the first quarter.